stamp duty malaysia

Download Form - Stamp Duty Category. The tiers are as follows with effect from.

Stamp Duty Malaysia 2022 Commonly Asked Questions Malaysia Housing Loan

Meanwhile if you wish to know more about the.

. RM5000 or 10 of the deficient duty whichever is the greater if stamped after 3 months but not later than 6 months after the time for stamping. The calculation formula for Legal Fee Stamp Duty is fixed as they are governed by law. Stamp duty for instrument of transfer Stamp duty on loan agreement Total stamp duty to be paid.

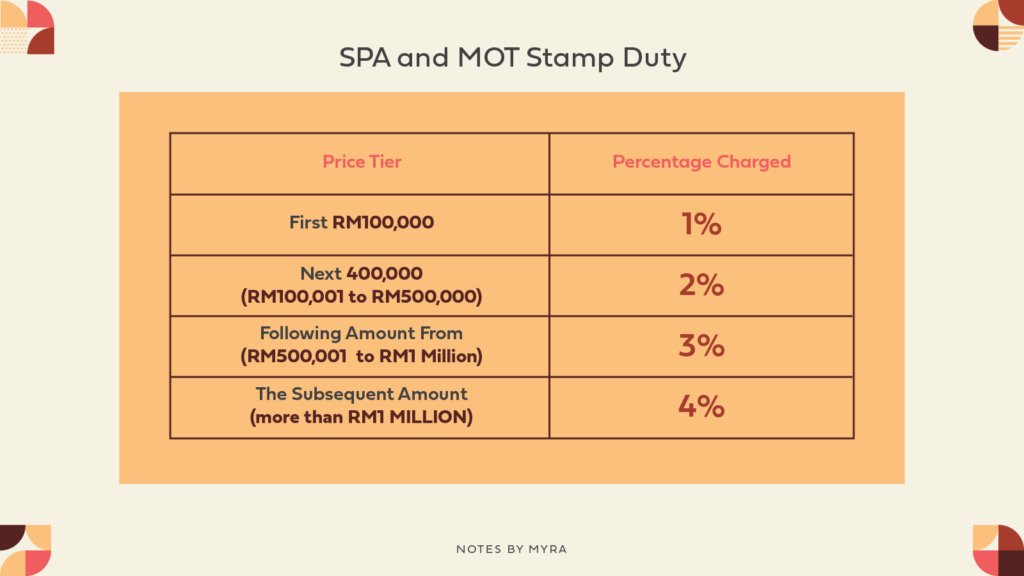

Please contact us for a quotation for services required. Stamp duty is a tax based on specific tiers with its own percentage for each level. --Please Select-- 2022 2021 2020 2019 2018.

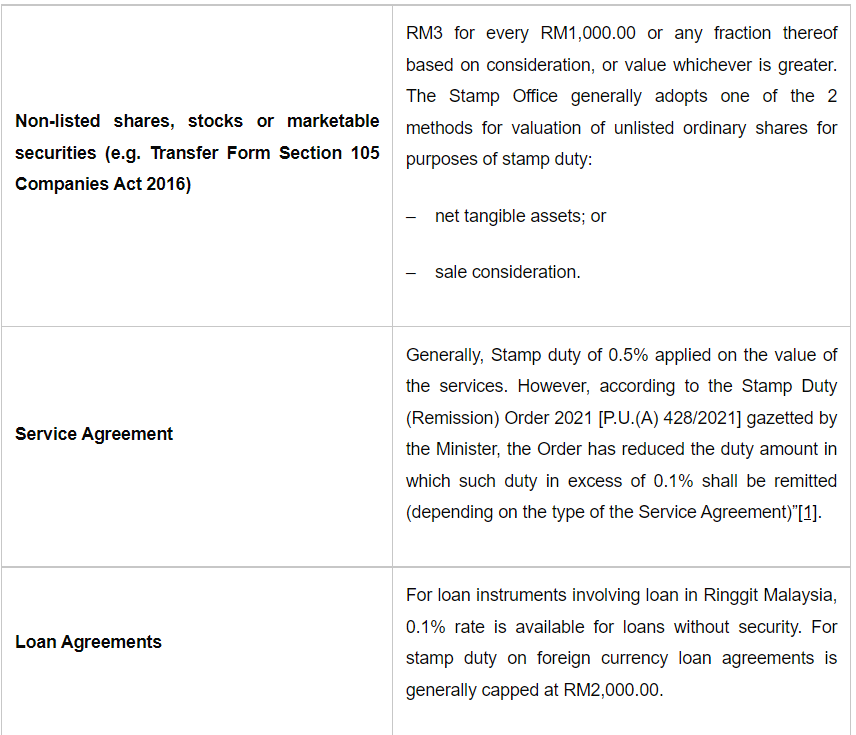

In Malaysia stamp duty is a tax levied on a large number of written instruments defined in the First Schedule of Stamp Duty Act 1949. --Please Select-- STAMP DUTY PAYMENT COMPOUND DUTY PAYMENT OTHER FORMS Semua All Year. Stamp Duty Exemption for First Time House Buyers from 1 January 2021 to 31 December 2025 Under Budget 2021 first.

This Stamp Duty on MOT. First RM100000 x 1 Next RM400000 x 2 05 of loan. 2 Between RM100001 and RM500000.

The Loans Guarantee Bodies Corporate Remission of Tax and Stamp Duty No. The Order provides that any tax. Malaysian Ringgit RM loan agreements generally attract stamp duty at 05 However a reduced stamp duty liability of 01 is.

We are blessed this year as the Malaysia Government decided to extend the Stamp Duty Exemption from the previous year and increase the Property Value with stamp duty. 3 Between RM500001 to RM1 million. A 322 was gazetted on 11 October 2022.

The Actual Calculation of Stamp Duty is before first-time house buyer stamp duty exemption-Stamp duty Fee 1. For First RM100000 RM1000 Stamp duty Fee 2. Fixed tier duties are charged in the following rates.

Stamp duty is the amount of tax levied on your property documents such as the Sales and Purchase Agreements SPA the Memorandum of Transfer MOT and the loan agreement. What are the latest stamp duty exemptions in Malaysia. In Budget 2021 it was proposed that the stamp duty exemption provided on the relevant instruments executed by the original house purchaser and the approved rescuing.

1 On the first RM100000 of the price of the property. In Malaysia stamp duty is a tax imposed on legal commercial and financial documents specified in the First Schedule of Stamp Duty Act 1949. 4 Order 2022 PU.

RM10000 or 20 of the deficient duty. Loan agreement loan instrument. In general stamp duty is applied to legal.

Stamp duty stamp duty malaysia what is stamp duty. The two types are namely. Some Stamp duty is paid fully by buyer and some are shared between buyer and seller and some are fully covered by Developer different situation will be different.

Malaysia 2021 Vs 2022 Stamp Duty On Share Trading Contract Notes Youtube

Spa Stamp Duty Malaysia And Legal Fees For Property Purchase

Business Sale Agreement Is Subject To Nominal Stamp Duty International Tax Review

Stamp Duty And The Value Of Shares

Why Could This Green Chop Cost You Thousands Of Ringgit Asklegal My

Property Stamp Duty Malaysia Housing Loan

Setem Hasil Stamp Duty Shopee Malaysia

Malaysian Tax Law Stamp Duty Lexology

Irbm Uses New Stamping Application Process

Stamp Duty Exemption Under I Miliki Announced By The Prime Minister On 15th July 2022 Publication By Hhq Law Firm In Kl Malaysia

The Ultimate Tool To Calculate Monthly Installments Interest Payable And Legal Fees Stamp Duty In Malaysia Stamp Duty Refinancing Mortgage Loan Calculator

Exemption For Stamp Duty 2020 Malaysia Housing Loan

How Much Does The Stamp Duty For Your New Home Cost

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Contactless Rental Stamp Duty Tenancy Agreement Runner Service

Current Stamp Duty Calculation Hhq Law Firm In Kl Malaysia

Malaysia Legal Fees Cal Apps On Google Play

Hoc Program 2020 Marcus Keoh Mk Real Estate Facebook

I B Malaysia Revenue Duty Stamp 1 Small Format Asia Malaysia Stamp Hipstamp